My goal is to back contrarian builders. Builders that come off as crazy yet visionary at the same time. Builders I can get my hands dirty with, who amp me up with their vision and challenge me daily. Builders I can partner with and welcome into our family.

Throughout my journey as a founder and investor, I’ve constantly chased ideas that redefine how industries operate. That’s where I’ve felt I could have the greatest impact. This desire is what initially led me to leave MIT, and the same rationale brought me to early-stage venture capital, where I could support and partner with founders solving painful problems in massive markets.

I’ve leapt headfirst into groundbreaking ideas, associating myself with like-minded individuals who make me look a little more sane by comparison. These contrarian builders ─ the ones willing to do whatever it takes to achieve their vision ─ are the future. I’m excited to announce the launch of the firm built to support these types of rebels ─ REMUS Capital.

The Firm

This past year, I’ve been building REMUS alongside an amazing group of colleagues. We’ve built our firm to support only the most audacious, highest-caliber founders transforming massive industries and/or commercializing research from top-tier groups. We lead Seed, Series A, and Series B rounds.

Our concentrated approach to investing drives us to go all-in with all our companies, rather than the traditional diversified, “spray-and-pray” approach to portfolio construction, which hangs underperforming businesses out to dry. Our founders are a part of our tightly-knit family, and REMUS only thrives when each of them thrives alongside us.

At our core, we are hungry to build. With both youth and experience on our side, we admire those with an irrational belief in their vision with the desire to forge legendary companies worth $5B and more.

Doubling down on sleepy industries

While the following truth within Oil & Gas perturbs many ─ “Global CapEx spending for the industry hits a 13-year rock bottom” ─ this is the type of news that excites me.

Pharmaceuticals, Oil & Gas, Construction, Healthcare, Agriculture. The vast majority of investors will not touch these sectors with a ten-foot pole given the short-term shock they’re facing thanks to COVID-19, but the shock is exactly that ─ short-term. Even during normal times, investors often avoid these “sleepy” sectors due to long sales cycles and far slower adoption times. Despite this industry-wide reticence, I’ve been very bullish on companies innovating in these verticals in the past. The looming global pandemic has only fortified my conviction. Put simply, as incumbents in these spaces scramble to cut costs due to virus-driven liquidity and solvency issues, technology companies that can provide strong, bottom-line ROI are seeing shorter sales cycles and quicker adoption.

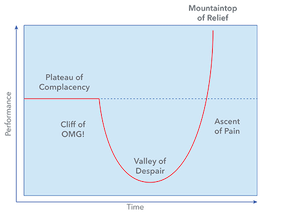

Additionally, a massive barrier to entry in these traditional verticals has historically been adoption friction. The depth of the adoption J-curve has made it almost impossible to force change among industry leaders, causing them to lag decades behind younger verticals. Put another way, the initial loss of efficiency outweighs the future potential upside. This is not a new idea, but many fail to realize that the short-term impacts of COVID-19 will lead these industries to finally make it through that “valley of despair” into a technological nirvana! I’m excited to find a handful of all-star founding teams capitalizing on this theme.

Science-driven companies

I continue to be bullish on backing founders spinning-out deep IP from top research institutions. I’ve worked with a number of companies out of the MIT Media Lab and Harvard Medical, and their core defensibility paired with deep industry expertise builds significant economics moats, mitigating much of the initial risk taken by early stage investors in crowded industries. An enterprise SaaS company selling into the customer experience space, for instance, will have a challenging time building a billion-dollar business without strong technical differentiation.

Staying plugged into academic innovation truly gives one a glimpse of the future. While not every university spinout will be a fit for us, I love geeking out to new and exciting frontier tech.

I am eager to build REMUS over this coming decade, leveraging our agility and entrepreneurial ethos as a firm to support a new wave of resilient founders. We like defying the crowd, following our instincts, and proving them wrong.

If this resonates with you, please reach out.

— Stash

stash (at) remuscap